Crafting a successful fundraising strategy involves navigating a complex and time-consuming process, often overlooked by many startup founders.

Having been immersed in this realm I’ve observed several critical aspects that warrant attention:

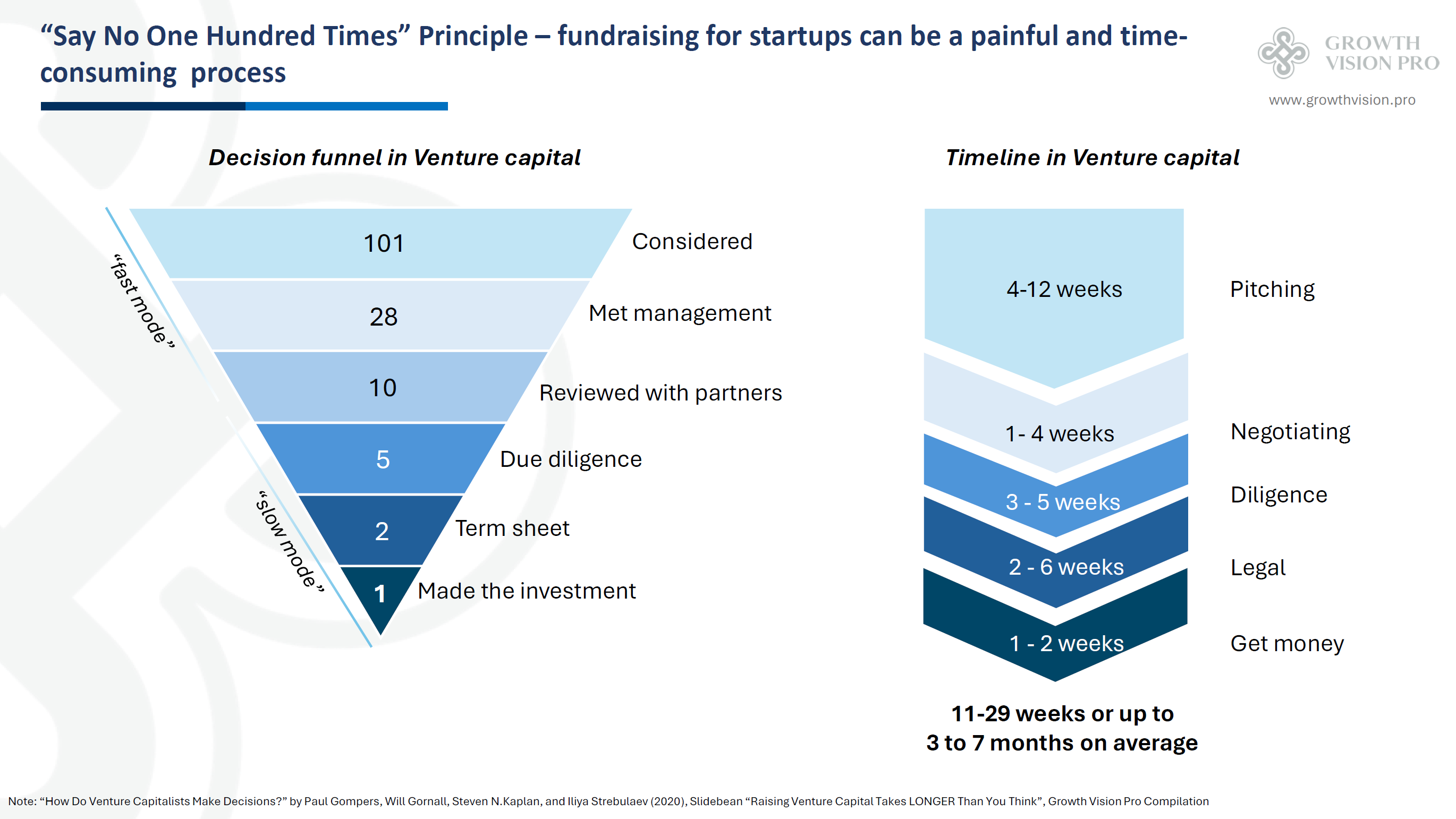

🏃♂ Long-Term Perspective: Recognize that fundraising is akin to a marathon, not a sprint. It demands significant time and resources, with the average investor engagement process spanning 3-7 months. Startups must anticipate this timeline, ideally initiating the fundraising process at least six months before running low on cash reserves.

🎤 Beyond the Pitch: While a compelling pitch can streamline the pool of potential investors, securing funding isn’t guaranteed. Although this phase may swiftly trim down candidates, it’s the founders and their innovative solutions that leave a lasting impression. However, this phase is just the beginning.

🔍 Navigating Due Diligence: Proper due diligence preparation is paramount. Competing against top peers demands clarity in business plans, financial models, team capabilities, data room readiness and legal safeguards like IP protection and shareholder agreements. Neglecting due diligence readiness risks undoing prior efforts, potentially eliminating startups from the finalist pool. Having multiple acceptable scenarios via financial models can be a game-changer in investor negotiations.

Before deep diving into the fundrasing process check your initial investment readiness by taking a free test here.

Credit: Ilya Strebulaev, Slidebean, Growth Vision Pro