Category: Uncategorized

-

☝️Part 10 readiness for investors

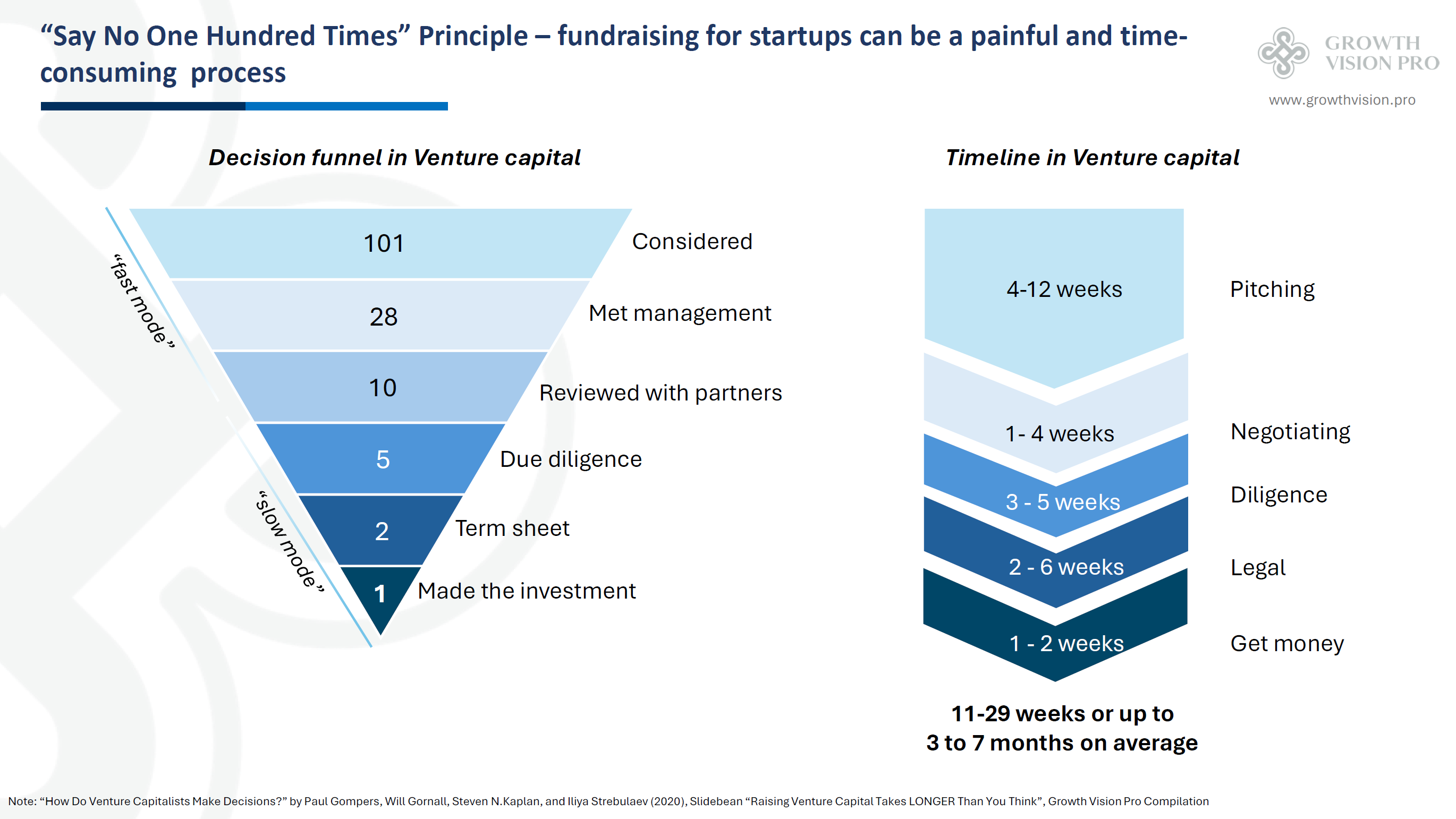

Crafting a successful fundraising strategy involves navigating a complex and time-consuming process, often overlooked by many startup founders. Having been immersed in this realm I’ve observed several critical aspects that warrant attention: 🏃♂ Long-Term Perspective: Recognize that fundraising is akin to a marathon, not a sprint. It demands significant time and resources, with the average Read more

-

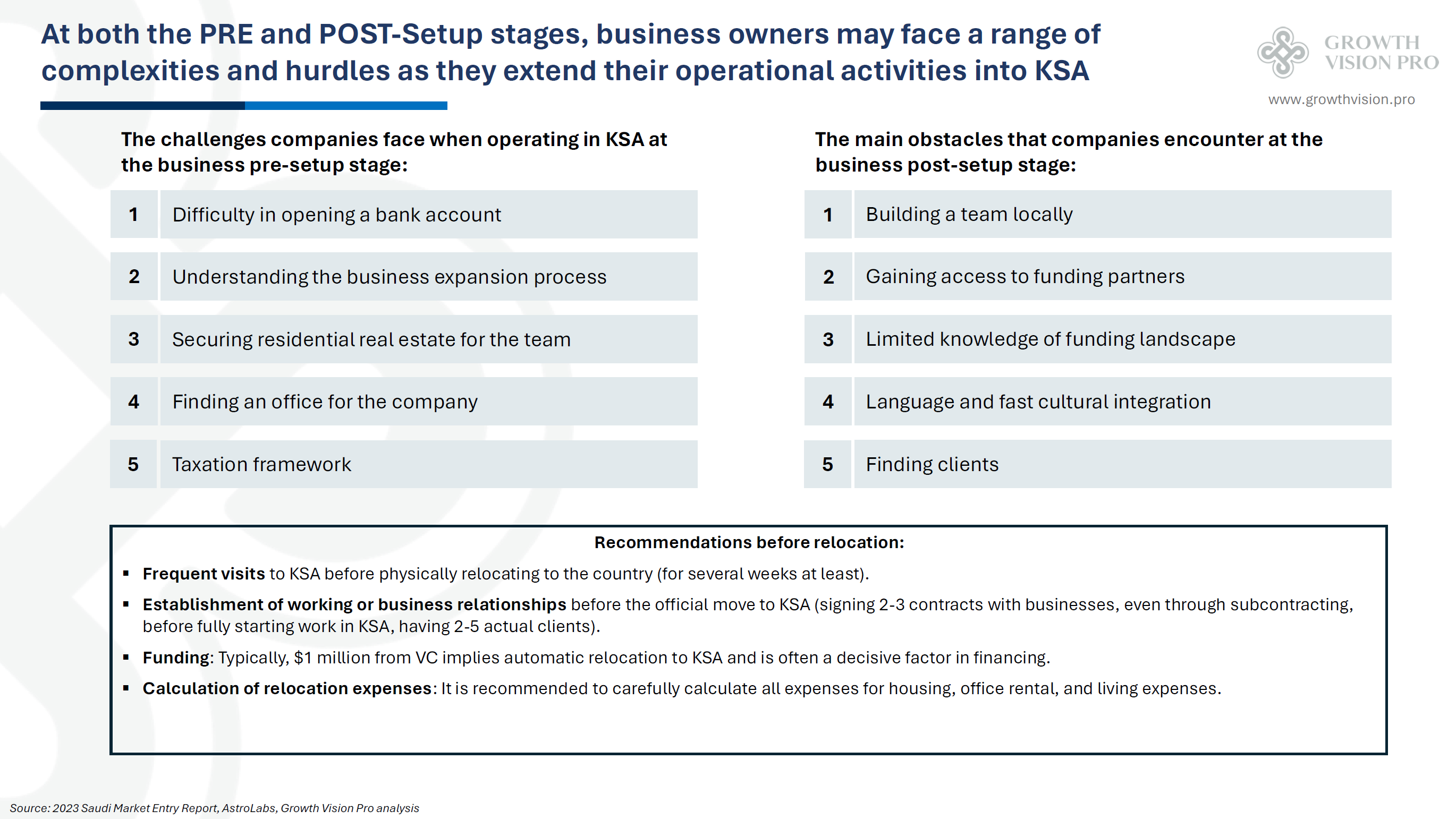

🌍 Looking to expand your business into promising markets like Saudi Arabia? It’s crucial to understand the landscape and challenges for founders. KSA Part 9 pre and post setup challenges

🌍 Looking to expand your business into promising markets like Saudi Arabia? It’s crucial to understand the landscape and challenges for founders. 📈 Saudi Arabia (KSA) holds immense potential for tech startups and traditional businesses, but it’s still an emerging market with evolving ecosystems.🔍 Prior to relocation, founders must address operational and organizational tasks like Read more

-

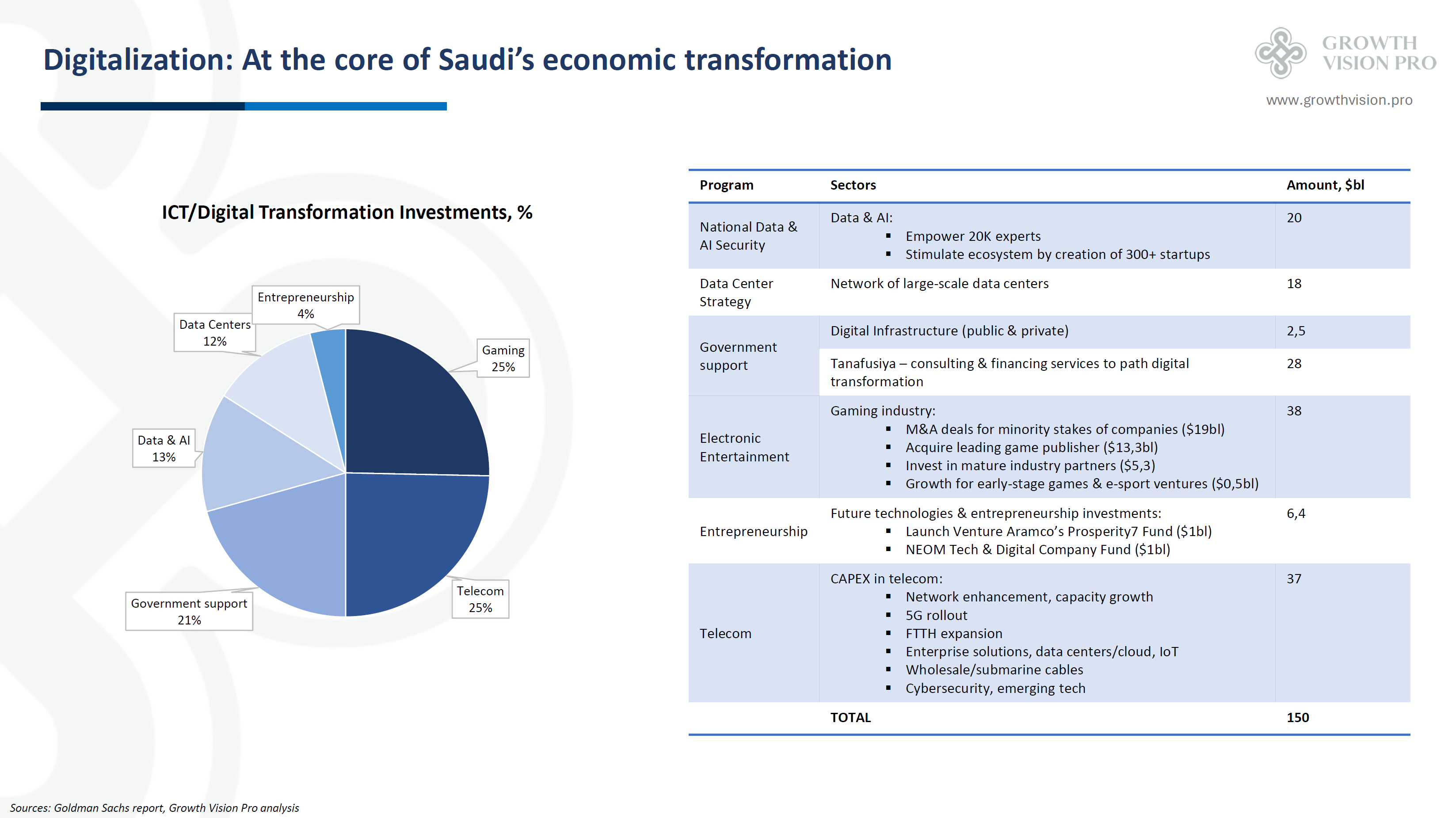

✨Digitalization: At the core of Saudi’s economic transformation (Part 8)

A significant portion, approximately 14% or around $150 billion, of the $1 trillion investment across six key sectors according to the National Investment Strategy is earmarked for ICT/Digital transformation objectives. Here’s a breakdown of the opportunities: 1) Data and AI Industry: With a $20 billion investment goal, this sector plans to empower over 20,000 experts Read more

-

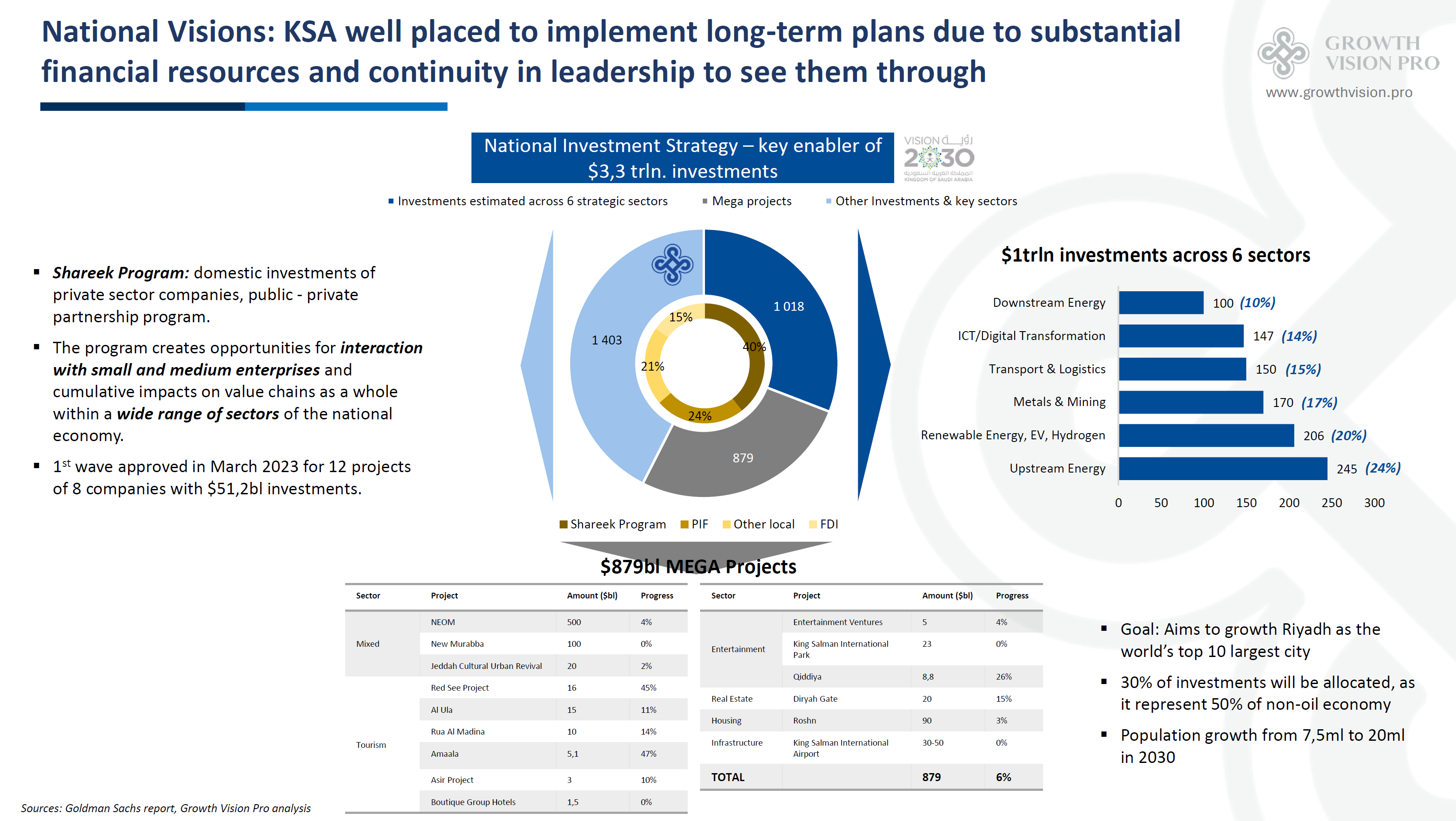

💼Investment Opportunities in Saudi Arabia (Part 7)

The National Investment Strategy, a crucial aspect of Saudi Vision 2030, aims to support $3.3 trillion in investments. It plans to fund 40% through the Shareek program, 24% through PIF, 21% from local sources, and 14% from FDI. Specifically:1) $1 trillion will be invested across six key sectors, with 66% going to traditional sectors like Read more

-

📈Venture Capital Market (Part 6)

🚀 Venture Capital Insights: GCC Region 2023 🚀 The venture capital landscape in the GCC region witnessed significant shifts in 2023, reflecting broader economic trends and investor sentiment. Here are some key takeaways: 1) Slowdown and Caution: Amid a global economic slowdown, the Middle East (ME) experienced a 23% year-on-year decrease in funding in 2023. Read more

-

✅Alternative markets (Part 5)

The GCC, once seen primarily as a capital source, is now increasingly recognized for promising investment opportunities in the global alternatives industry 💰 Over a 16-year period from 2008 to Q3 2023, global private capital raised $15.3 trillion, with North America leading at 55%. Surprisingly, the Middle East only accounted for $86 billion, representing a Read more

-

📊 GCC: A Snapshot of Global Rankings (Part 4)

Understanding global rankings is pivotal to grasping how countries fare in competitiveness, innovation, and governance. Let’s delve into the details: 1. Global Competitiveness: The UAE stands at an impressive 10th place globally in the competitiveness ranking, right after Sweden and the USA. All GCC countries are among the top 25 closer to global leaders. 2. Read more

-

🏛️ Insights into Monetary and Fiscal Policies of the GCC countries (Part 3)

Today’s LinkedIn post explores the critical realm of Monetary and Fiscal policies within the GCC, offering valuable insights for businesses eyeing the region for growth. Here are the key takeaways: 1. Oil Resilience: 2. Currency Pegging Dynamics: 3. USD Influence: 4. Financial Stability Collaboration: 5. Business-Friendly Initiatives: Stay tuned for more in-depth analyses! Read more

-

💰GCC FDI net inflows and State-Owned Investor balances (Part2)

GCC FDI net inflows and State-Owned Investor balances create a solid financial buffer to uphold any financial challenges or oil price decline and fund ambitious growth plans FDI Ambitions: State-Owned Investors Dynamics: In this era of transformation and competition, the GCC countries, particularly Saudi Arabia, the UAE, and Qatar engage in a strategic bid for Read more

-

🌍 Unlocking GCC Business Frontiers: A Rapidly Growing Economic Landscape – Part 1 Macro Overview

The GCC region is a powerhouse of forward-thinking growth, experiencing significant economic upsurge. Economic Momentum:– A robust $2.2 trln GDP with a remarkable 6.9% growth in 2022.– SWFs taking center stage in the capital market, amassing a staggering $4.1 trln. Investment & Venture Landscape:– KSA and UAE, as economic giants, attracting $40 bl in FDI.– Read more